Taxes For Single Person 2025

Taxes For Single Person 2025. Your bracket depends on your taxable income and filing. Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2025 tax return in 2025.

The table shows the tax rates you pay in each band if you have a standard personal allowance of £12,570. If your combined income is more.

Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2025 tax return in 2025.

Federal Tax Table For 2025 Becca Carmine, A credit cuts your tax bill. Taxpayers can choose either itemized.

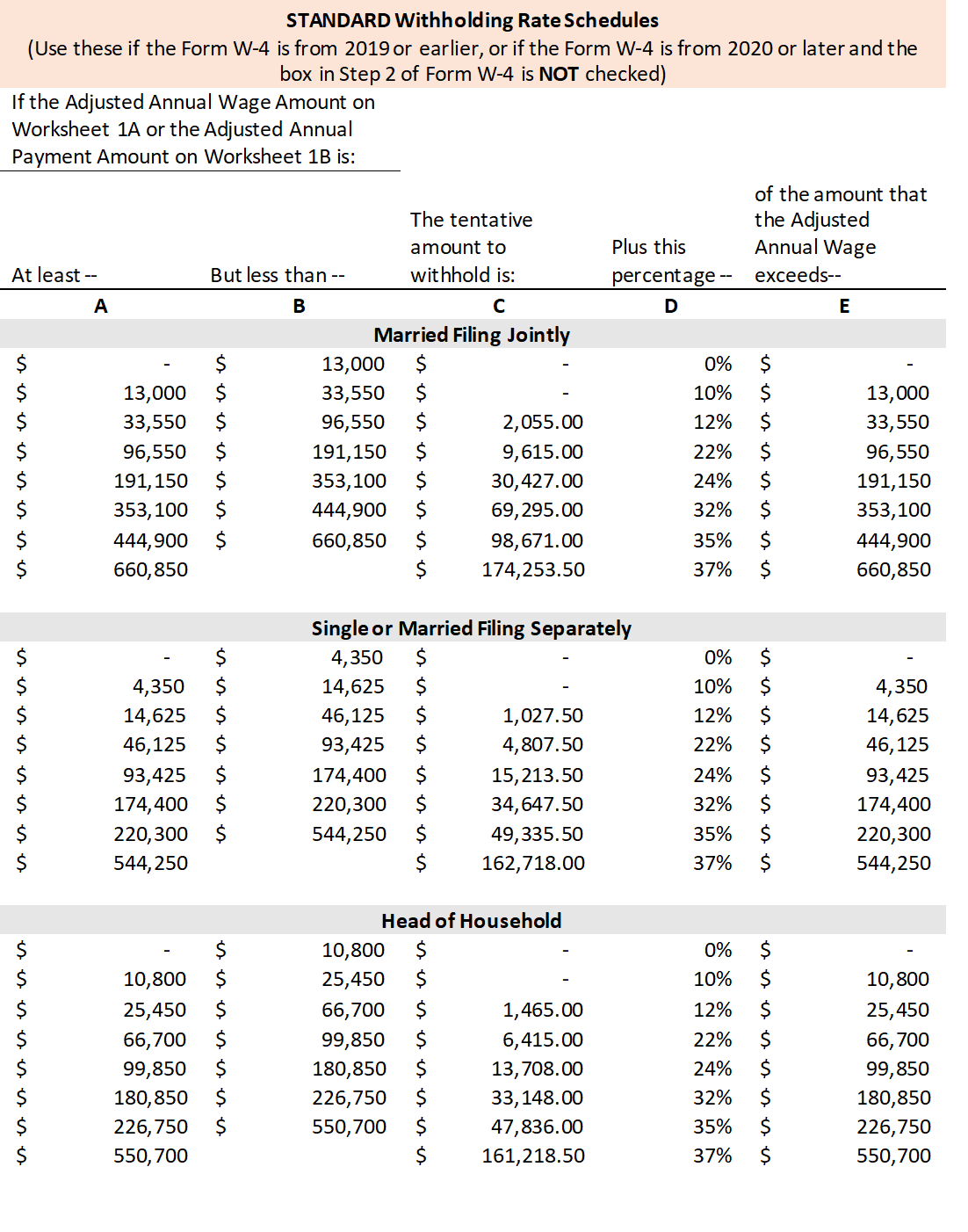

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). A deduction cuts the income you're taxed on, which can mean a lower bill.

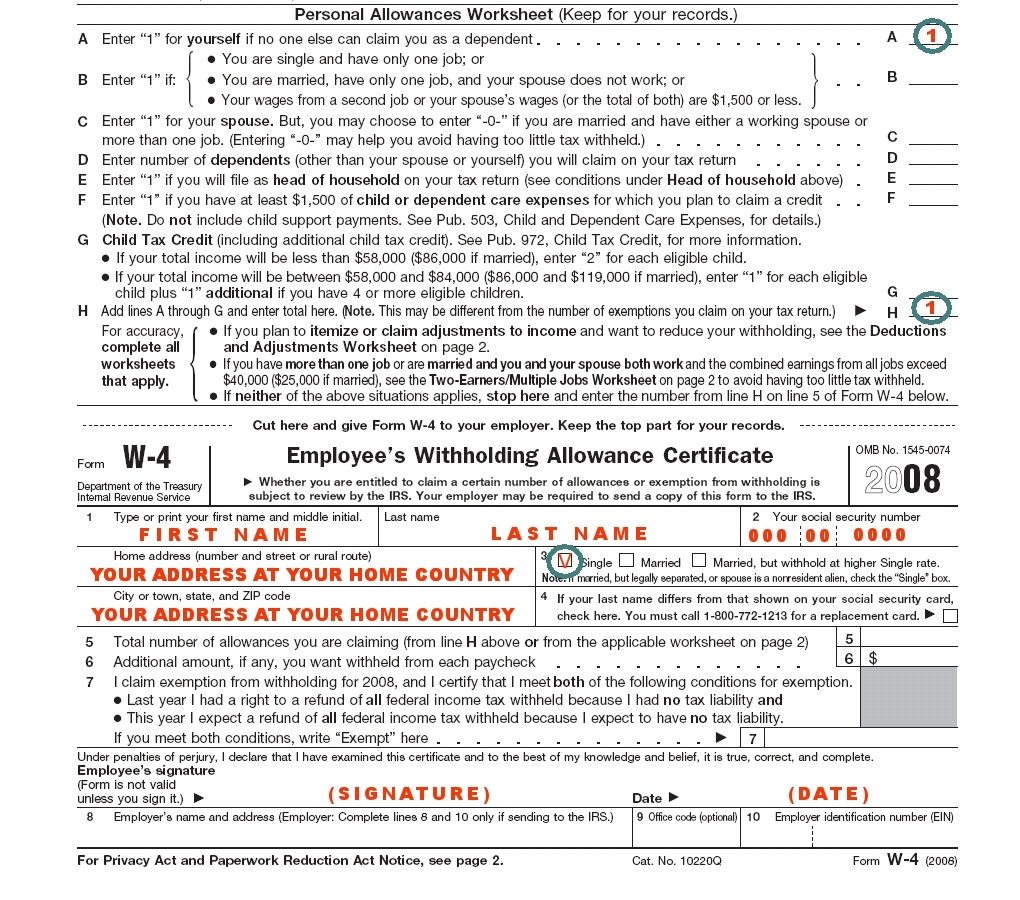

Sample W 4 Form 2025 W4 Form, Income tax rates and bands. Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2025 tax return in 2025.

The IRS Just Announced 2025 Tax Changes!, 2025 federal income tax rates. The standard deduction dollar amount is $14,600 for single households and $29,200 for married couples filing jointly for the tax year 2025.

How To Fill Out W4 Tax Form In 2025 FAST UPDATED YouTube, If your combined income is more. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to. The federal income tax system is.

How to fill out IRS Form W4 as Single with Kids YouTube, Tax credits and deductions for individuals. Minimum income requirements for filing taxes.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, You probably have to file a tax return in 2025 if your gross income in 2025 was at least $13,850 as a single filer,. A person must file a return if their gross income was at least:

Calculation of Federal Employment Taxes Payroll Services, Income tax rates and bands. The standard deduction dollar amount is $14,600 for single households and $29,200 for married couples filing jointly for the tax year 2025.

When Can I File Taxes For 2025 Essa Ofella, Minimum income requirements for filing taxes. Income tax bands are different if you.

You probably have to file a tax return in 2025 if your gross income in 2025 was at least $13,850 as a single filer,.

Hyundai Friends And Family Discount 2025. Browse the latest 2025 hyundai santa fe deals, incentives, […]

14 Freeway Accident Today 2025. 7news brings you the latest car accidents melbourne news. It […]