Jackson County Mo Tax Levy Rates 2025

Jackson County Mo Tax Levy Rates 2025. Overview of jackson county, mo taxes. Back to county information political subdivision name:

Although it’s too late for this year, jackson county seniors have been told they will be spared from the financial burden of soaring property assessments starting in. Missouri residents state income tax tables for head of household filers in 2025 personal income tax rates and thresholds;

Jackson county has warned that property assessments are increasing this year, and although that does not necessarily mean an increase in property tax bills,.

Tax Levy Charts Available Jackson County MO, When you subtract any exemptions from that 19%, you get your. 3:52 pm cdt sep 18, 2025.

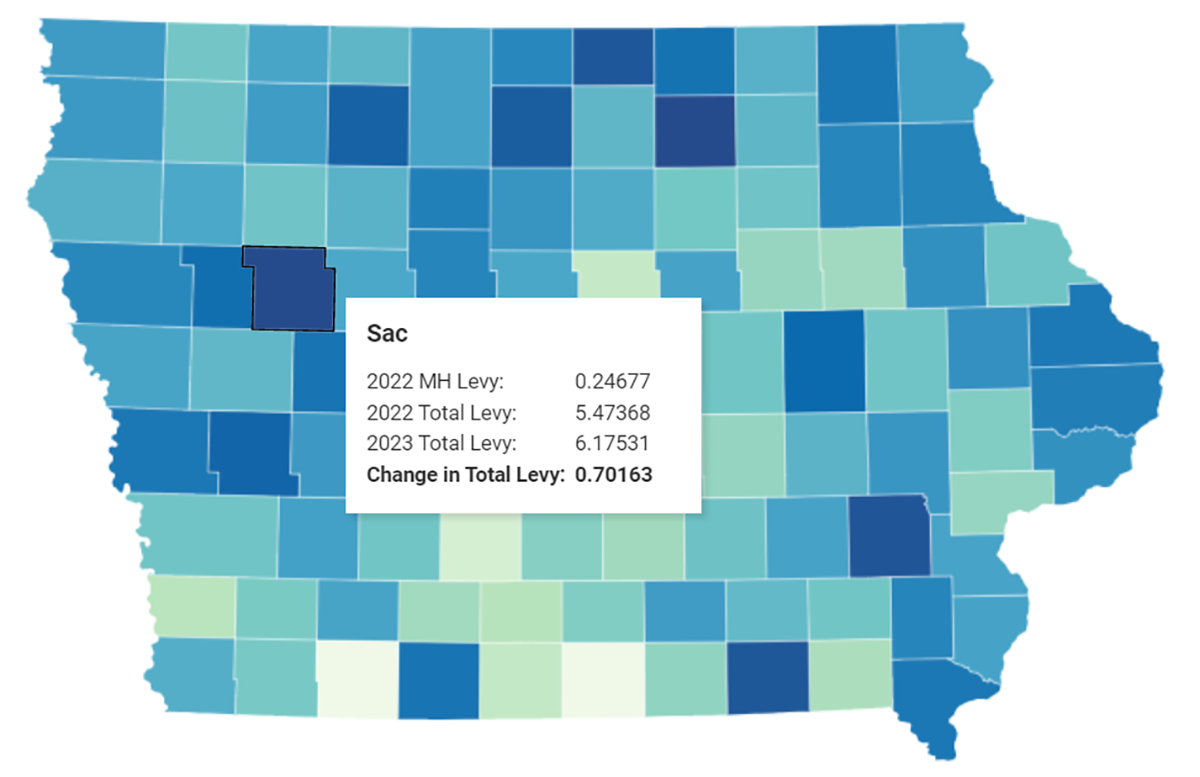

County Property Tax Levy Rates Iowans for Tax Relief, — the schools, cities, libraries and other jurisdictions which collect tax dollars from property owners in jackson county, missouri, have set. Jackson county legislature approves property tax credit for seniors for 2025 tax year.

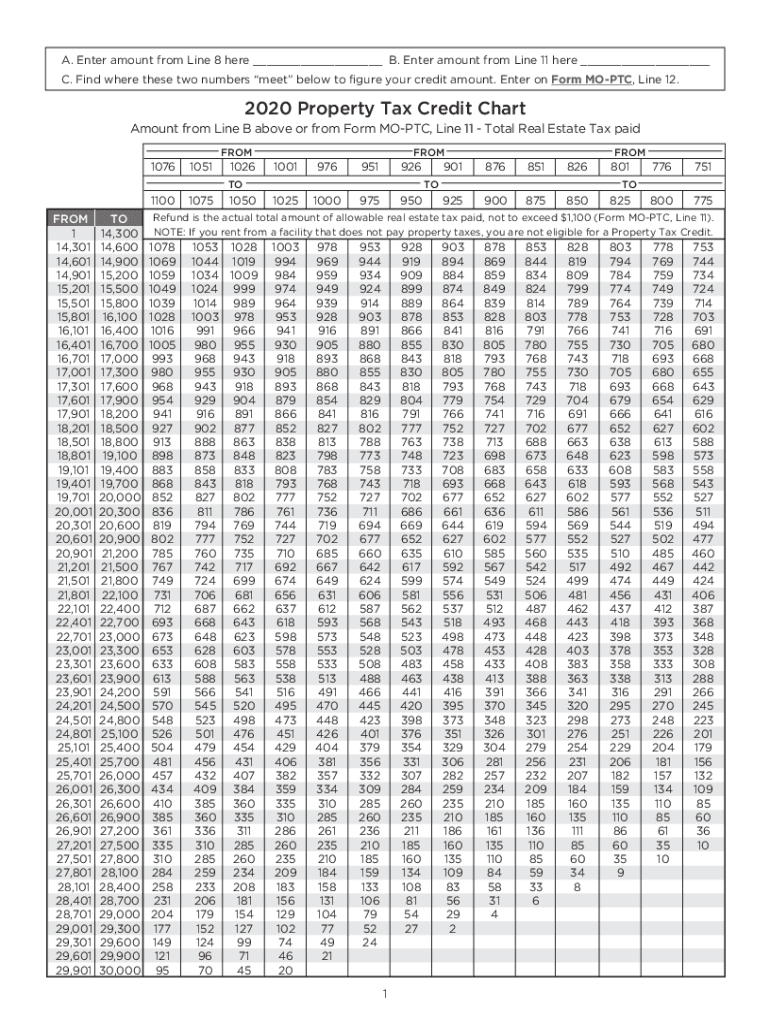

Find the Best Tax Preparation Services in Jackson County, MO, The amount of tax you owe is based on the assessed value of the tangible personal property you owned on january one of that year and the levy rates provided by the. Look up 2025 sales tax rates for jackson county, missouri.

.png)

Monday Map Combined State and Local Sales Tax Rates, The following taxing jurisdictions are scheduled to discuss their tax levies on these dates. — roughly 30,000 appeals of jackson county property tax assessments remain pending midway through july, but many taxpayers still have.

Pay Property Taxes online Jackson County MO, — the schools, cities, libraries and other jurisdictions which collect tax dollars from property owners in jackson county, missouri, have set. Tax rates provided by avalara are updated regularly.

Tax Rates 2025 To 2025 2025 Printable Calendar, Louis use the tax rates set by each taxing authority to levy taxes on all property including new. — roughly 30,000 appeals of jackson county property tax assessments remain pending midway through july, but many taxpayers still have.

Personal Property and Real Estate tax bills available online Jackson, That rate is above missouri’s state average. Tax rate taxable income threshold;

PRORFETY Property Tax Lookup Jackson County Mo, The current sales tax rate in jackson county, mo is 11.98%. When you subtract any exemptions from that 19%, you get your.

Eic table 2025 pdf Fill out & sign online DocHub, — the schools, cities, libraries and other jurisdictions which collect tax dollars from property owners in jackson county, missouri, have set. Look up 2025 sales tax rates for jackson county, missouri.

Crunching your Jackson County property taxes for 2025 what the numbers, Published on september 11, 2025. Missouri residents state income tax tables for head of household filers in 2025 personal income tax rates and thresholds;