2025 Olympics Commercial Tax Slab

2025 Olympics Commercial Tax Slab. Get the information about the current income tax slabs for individuals, senior citizens and super senior citizens on. Also, check the updated tax slabs for individuals.

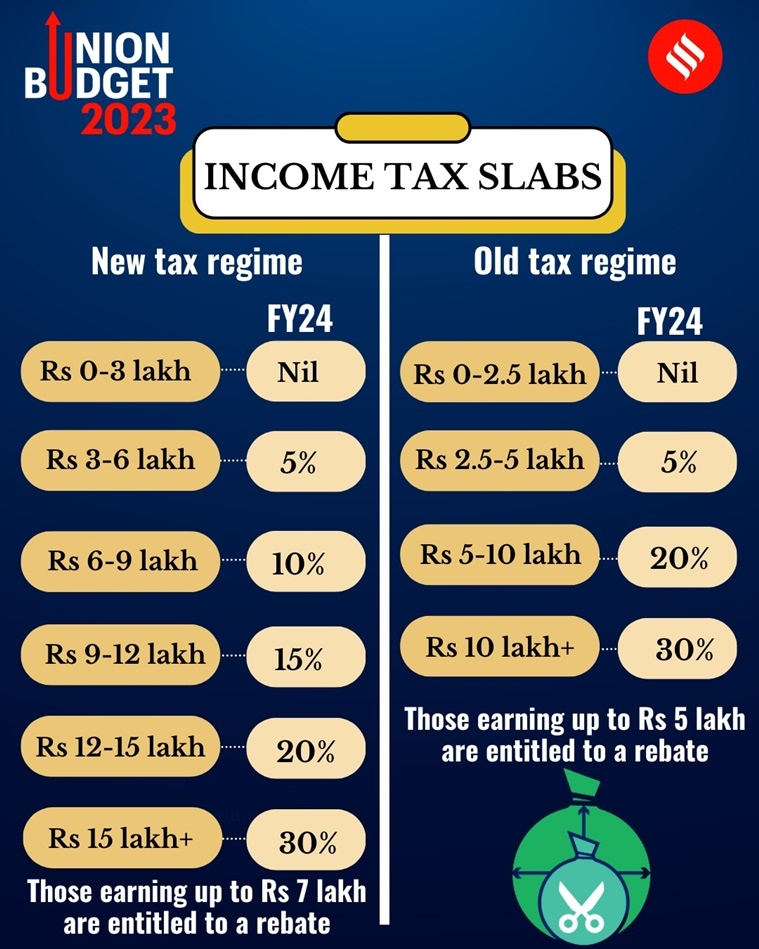

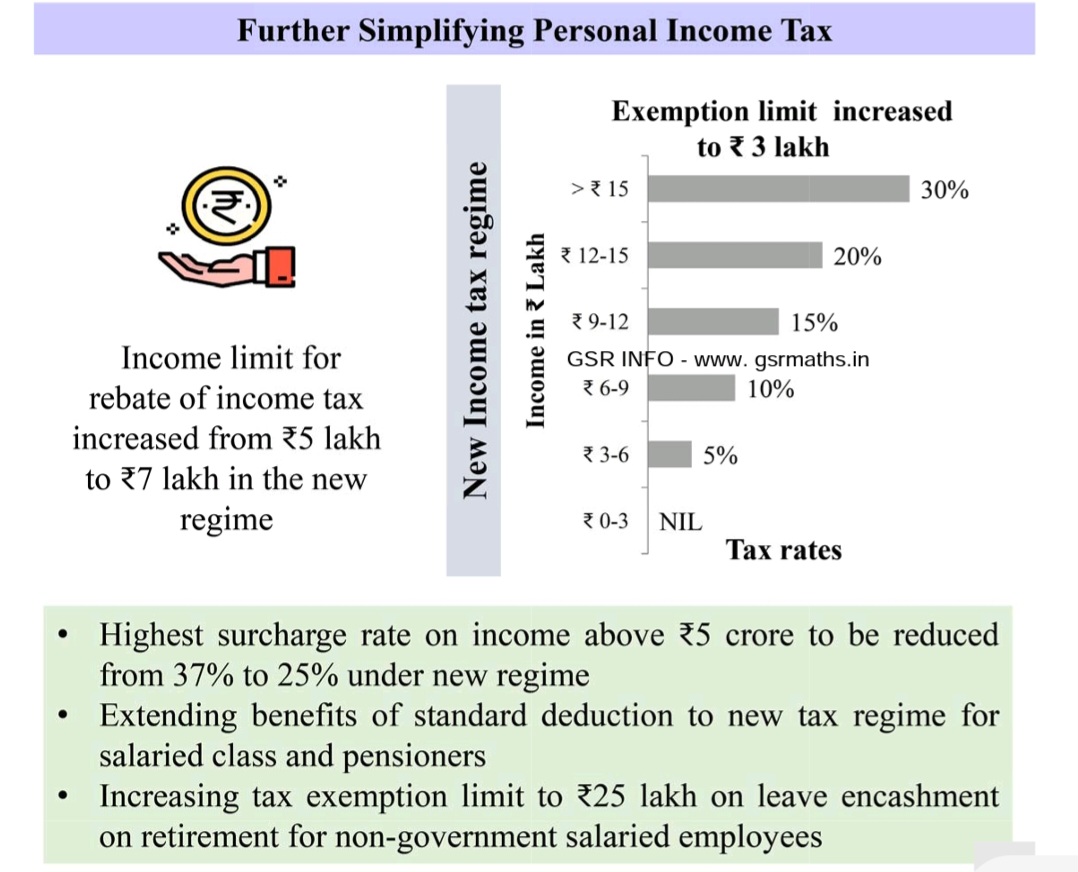

In the new income tax regime, the rebate eligibility threshold is set at rs 7,00,000, allowing taxpayers to claim a rebate of. The finance minister made changes in the income tax slabs under the new tax regime.

Olympics Paris 2025 Tax & VAT Guide VATupdate, Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the. How will budget 2025 impact you?

Choosing between the old and new tax slabs Value Research, In the new income tax regime, the rebate eligibility threshold is set at rs 7,00,000, allowing taxpayers to claim a rebate of. In the current financial year 2025, following the changes implemented in budget 2025, the maximum surcharge rate in the.

Tax Slab Rate Calculation for FY 202324 (AY 202425) with, What are income tax slabs? 02 feb, 2025 | 04:48:55 pm ist.

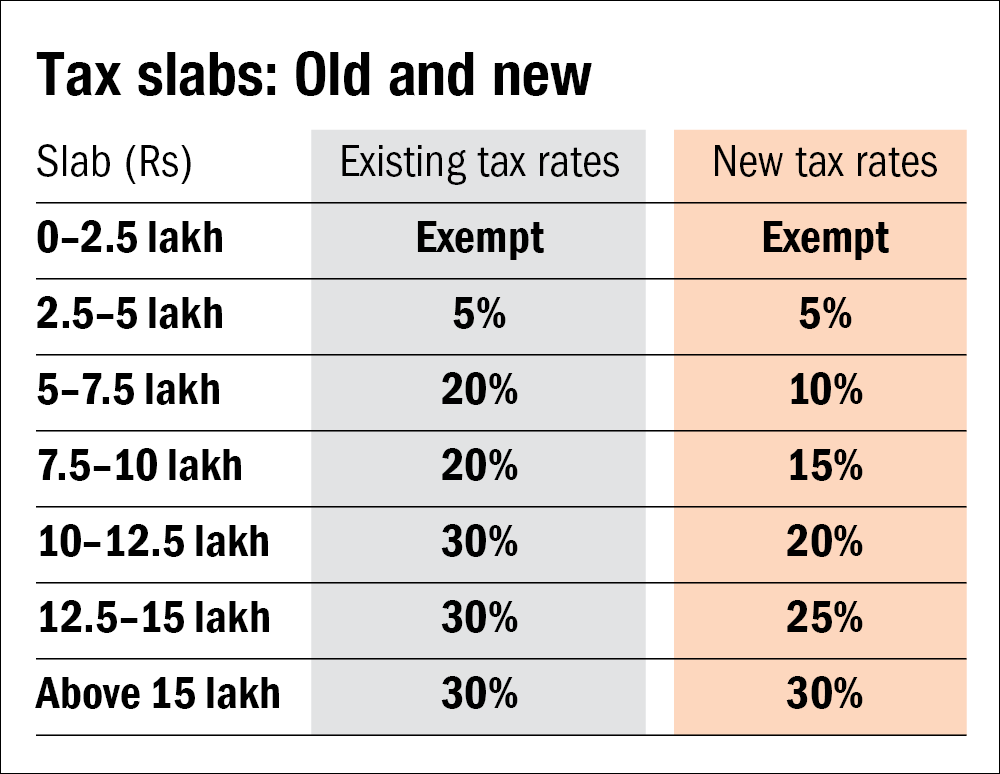

Choosing between the old and new tax slabs Value Research, Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the. The finance minister made changes in the income tax slabs under the new tax regime.

tax slab rate 20232024 tax calculation for salaried person old, During the union budget, the government of india announces any amendments to the income tax slabs for the financial year. No changes to tax rates, aligning with expectations of continuity.

What are the new slabs under the new tax regime, Income tax budget 2025 highlights | interim budget maintains status quo: Anticipating changes in income tax reforms?

LATEST IT SLABS FOR AY 20232024, 37% for income above rs 5 crore. How will budget 2025 impact you?

Budget 2025 Here are the fresh new tax regime slabs India Today, Income tax budget 2025 highlights | interim budget maintains status quo: Get the information about the current income tax slabs for individuals, senior citizens and super senior citizens on.

Budget 2025 Tax Slabs Explained New tax regime vs Existing new, During the union budget, the government of india announces any amendments to the income tax slabs for the financial year. Istockphoto) india's goods and services tax (gst) represents a significant shift in the.

Tax Slabs FY 202324 AY 202425 GSR INFO AP TS Employees, In the current financial year 2025, following the changes implemented in budget 2025, the maximum surcharge rate in the. It outlines the steps that games stakeholders must take in order to claim a refund of vat incurred in relation to the games and briefly discusses the procedures to be followed by games stakeholders that supply taxable goods and/or services and are required to.

According to the professional tax slabs in india for 2025, the first slab applies to individuals with an income up to inr 2,50,000.

In the new income tax regime, the rebate eligibility threshold is set at rs 7,00,000, allowing taxpayers to claim a rebate of.